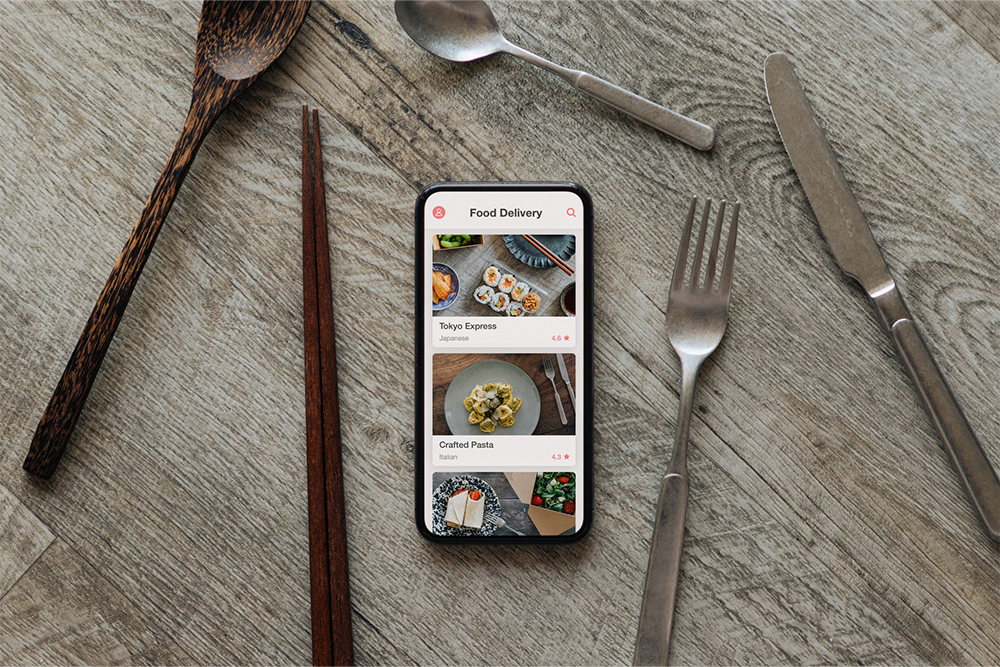

Third-Party Food Delivery and Takeout Apps Are All the Rage — Will They Last?

You don’t need me to tell you that COVID-19 has led to an uptick in the use of third-party apps like DoorDash and UberEats. In April of 2019, according to market research firm Ipsos, delivery made up nine per cent of full-service restaurant sales in Canada; a year later, that number had jumped by nearly 20 per cent. “Pre-pandemic, the delivery channel was around four per cent of the entire food service market,” Asad Amin, vice president at Ipsos, told market research website eMarketer. “Through the pandemic, it doubled, growing to eight per cent because all the focus was on off-premises, with dine-in closed. We saw a massive spike, especially early in the pandemic.”

After 18 months, industry analysts and restaurant owners across the world are still wondering whether these changes are here to stay or whether the demand for delivery will erode over time. The answer to those questions seems to hinge entirely on humans’ tendency to adapt.

“I think there will be a decline in delivery numbers, but I don’t think it will go back to what it was pre-pandemic,” says James Shea, publisher of Food Delivery News. “It took 18 months for new buying habits to be established, and those aren’t going to go back to the way they were in early 2020 or 2019. People decided that they like the convenience of delivery.” But our obsession with convenience has obscured the working conditions of the people delivering our food.

“The pandemic took restaurants into the digital age kicking and screaming,” says Shea. “[Pre-pandemic], a lot of them had resisted having online ordering and delivery, but they had no choice during the pandemic. All of a sudden, the third-party delivery apps were an easy way for them to start doing [business].”

The benefits of signing up for DoorDash or UberEats versus an in-house delivery system seem to outweigh the overall costs of the endeavour. If discoverable on an app, a restaurant will automatically have access to a larger pool of potential customers. Participating restaurants also don’t have to worry about delivery efficiency and the logistics of sending out a driver, since the apps have a built-in capability to map a driver’s route most efficiently. “It’s an operational aspect that restaurants don’t have to deal with,” says Shea.

The necessity of the apps, especially in a year that saw in-restaurant dining disappear almost entirely, isn’t lost on the app companies themselves. “To-go and delivery orders have provided Canadians with the ability to safely and conveniently access great local food options when and where they want it,” says a DoorDash spokesperson. “Restaurants were challenged to serve their customers in new ways. As an on-demand food platform, we worked closely with our restaurant partners to accommodate this demand while meeting top standards of quality and cleanliness.”

It’s true. According to a report by the Agri-Food Analytics Lab (AAL) at Dalhousie University, 4.2 million more Canadians ordered food online at least once a week in the second half of 2020 than before the pandemic.

Restaurant industry insiders are quick to notice the benefits that apps like UberEats provide. “Of course the third parties helped a lot, as no restaurant was ready to deliver [that many orders],” says Jérémie Assouline, a former Montreal restaurant manager. “But pretty quickly, eateries started complaining about costs, and a movement took place.”

That movement led to government intervention at a local level, with a number of provinces enacting mandates to cap the fees that each third-party app was allowed to impose (usually, 30 per cent of an order). In March of 2021, for example, Bill 87 officially passed in Quebec, noting that any platform with at least 500 restaurant customers could charge no more than 15 per cent for deliveries. Other provinces introduced similar laws during the pandemic and have yet to go back to the old ways.

“The percentage charged by apps was very high until the bill passed,” says Assouline. “The problem is the shortness of staff. It was so easy to get unemployment that people stayed home. The government supports us in a lot of ways, but they also created a worker shortage. After COVID-19, they need to help the whole industry, as restaurants have been hurt very badly and the chain of supply is broken.”

Although the government stepping in to safeguard the livelihood of local businesses may have helped, restaurant owners themselves have banded together to try to make a difference by setting up co-operatives meant to safeguard the rights of the eatery itself, the drivers, and consumers that can opt to be members of the system.

Radish, one such co-operative, hires delivery folks as employees and not gig workers, guaranteeing them associated rights. The couriers are paid a salary in addition to earning tips and benefits.

“Any profits made are redistributed to the restaurants and drivers in proportion to their involvement in the co-op,” says Radish CEO and restaurant owner Mansib Rahman. “Restaurants that bring more orders to the platform and drivers who work more hours stand to earn a higher share of the profits.”

The overall consensus seems to be that the pandemic accelerated industry changes that were already underway. UberEats and DoorDash had already sent shockwaves through the industry, signalling the potential to be part of a city’s culinary pulse without actually making food.

“COVID acted as a catalyst and accelerant more than anything,” says Rahman. “It forced a lot of restaurants who were less competitive to either adapt or shutter. Those with more affordable leases, better employee retention due to loyalty, menus with higher profit margins, increased adoption of line delivery, and pickup solutions fared better than those who didn’t. In practice, it means that McDonald’s fared better than the mom-and-pop shops.”

Shea echoes Rahman’s sentiments. “Delivery fits into the overall digital transformation of the restaurant industry,” he explains. “This happened in the hospitality industry about 15 years ago, when people moved to third-party platforms to order plane tickets or book hotels.”

Solutions that would benefit all parties involved aren’t easy to come by. It’s clearly not as simple as suggesting that third-party app fees should be capped, as those platforms are helping restaurants reach a larger client base they would otherwise not have had access to. On the other hand, restaurants already work within tight margins, and additional fees may simply squeeze them too thin.

“The pandemic took restaurants into the digital age kicking and screaming. Pre-pandemic, a lot of them had resisted having online ordering and delivery, but they had no choice during the pandemic. All of a sudden, the third-party delivery apps were an easy way for them to start doing business.”

Diners are slowly trickling back indoors, but delivery is here to stay. “There remains a massive digital opportunity for restaurants,” says the DoorDash spokesperson. “While the pandemic served as a catalyst for many restaurants’ adoption of digital technology, including delivery, there is still an exciting opportunity for small businesses by leaning into all sides of their business — in-store, online, and through third-party partners.”

Ultimately, the traditional restaurant model will be forced to adapt, if the rise of ghost kitchens — facilities dedicated to the cooking of delivery-only meals — is any indication. “We’re likely to see a shift in the type of restaurant business models that succeed in the coming decade,” says Rahman. “We’re already seeing ghost kitchens take hold in many markets, often with the backing of the delivery platforms or restaurant chains themselves. With consumers increasingly interacting with restaurants purely through apps, this trend is only likely to accelerate.”

Regardless, one thing is for sure: the relationship between restaurants and third-party platforms is in flux. “I think you need less animosity between the restaurants and the delivery companies,” says Shea. “But I don’t know how you repair that, because if you talk to any owner about delivery, the first thing they do is complain about the fees. But at the same time, they understand they need the delivery services.”

There is, however, an aspect to the industry that those involved in conversations about the importance of delivery seem to gloss over: the actual act of dining out, which could never be replicated by any third-party app. Of course, given the conditions dictated by a pandemic that forced everyone to stay indoors for over a year, takeout options flourished. But hopefully, the future will not look like our present, and diners are sure to soon crave the experience and atmosphere that only eating inside a restaurant can guarantee. When that happens, third-party apps, ghost kitchens, and any other party that benefits from off-premises dining will have to modernize once again, and figure out how to survive while adjusting to humans’ fluctuating lifestyles. After all, we won’t be ordering in forever.